- School District of Clayton

- Frequently Asked Questions

-

Proposition E Frequently Asked Questions

Have an additional question? Email us at communications@claytonschools.net.

Click here to download a PDF of the FAQs.1. What is Proposition E?

Proposition E is a proposal on the April 2, 2019, ballot asking voters who live within the School District of Clayton to consider an operating levy increase of 56 cents per $100 of assessed valuation and an eight-cent waiver of Proposition C sales tax revenues. The net effect of both measures will provide the District with an additional 64 cents per $100 of assessed valuation. The additional revenue would be used to maintain and strengthen the District’s academic excellence and fiscal stability by eliminating the gap between revenues and expenses, addressing facility and maintenance needs and rebuilding reserves. Prop E requires a simple majority vote (50 percent plus 1).2. When is the election?

The election is April 2, 2019. Polls will be open from 6 a.m. to 7 p.m. Absentee ballots may be obtained from the St. Louis County Board of Elections (725 Northwest Plaza Drive, 314.615.1833) until 5 p.m. on March 20 and must be submitted by 5 p.m on Monday, April 1. The deadline to register to vote in the April 2 election is March 6.3. How will Prop E appear on the ballot?

The following is the proposal voters will consider on April 2:“For the purpose of providing competitive salaries, maintaining class sizes, avoiding cuts in educational programs, improving building safety, and funding other District needs, shall the Board of Education of the School District of Clayton, St. Louis County, Missouri be authorized to eliminate fully the sales tax reduction in its operating tax levy for school purposes as provided under Section 164.013 RSMo, and increase the operating tax levy ceiling of the District to $3.6773 for residential real property, $4.2276 for commercial real property and $4.0076 for personal property per $100 of assessed valuation? If this proposition is approved, the operating levy ceiling of the District is estimated to increase by $0.56 per $100 of assessed valuation for residential real property, commercial real property, and personal property.”

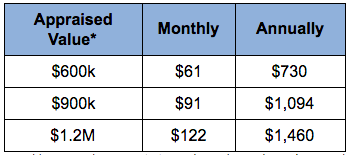

4. How much will my taxes increase if Prop E passes?

For every $100,000 of appraised value*, a homeowner will pay an additional $121.60 a year.

*This table illustrates the proposed increase in property taxes based on a home’s appraised value, which is the approximate market value of a home. Assessed value for residential property is calculated at 19 percent of appraised value.5. When was the last time the District asked for an operating levy increase?

The last operating levy increase was approved by voters in 2003. That 65-cent increase was projected to provide sufficient operating funds for the District for the next three years; however, that increase has lasted for 16 years because of sound fiscal management by the District.6. How was it determined to place Proposition E on the April 2 ballot?

The Board of Education and District Administration closely monitor the fiscal health and academic performance of the District. Working with the District's Long-Term Financial Planning Committee over the past two years helped confirm that the District would need to seek a revenue increase soon. The District has been prudently using its reserves to maintain academic excellence and offset the gap between its revenues and expenses, which, absent an operating levy increase, is projected to be $4.8 million in Fiscal Year 2020. The Board also reviewed feedback provided by participants in the FOCUS community engagement program, information from staff and the results of a District-wide community engagement survey in making the decision to place Prop E on the April 2 ballot.7. What happens if Proposition E fails?

The Board of Education and District Administration believe that another wave of expenditure reductions would result in staffing cuts that would have a significant negative impact on the education of our students. For example, in order to balance the 2019-2020 budget, the District would have to cut approximately $4.8 million from its budget. Given that faculty and staff expenses comprise 80 percent of the District’s budget, a significant portion of that reduction would affect teaching staff resulting in larger class sizes, fewer instructional support personnel, less comprehensive course offerings and a reduction of building maintenance funds.8. How was the amount of the requested increase determined?

The amount of the requested increase, which was developed after nine months listening to the community and gathering critical feedback, including conducting input sessions last March, hosting FOCUS Open Houses in November and meeting with advisory groups in December, was determined based on the need to close the gap between projected revenues and expenses, rebuild reserves and provide funds to address maintenance and facility needs while also maintaining academic excellence and programming and continuing to meet community expectations for our schools. The proposal for a 56-cent operating tax increase and eight-cent Prop C waiver will provide funding to maintain programs and facilities while ensuring the District’s fiscal health for at least the next five years.9. What is Proposition C?

Prop C, adopted in 1982 and known as the Missouri School and Highway Tax Proposition, is a statewide one-cent sales tax primarily used to fund education. The tax is collected throughout the state and distributed to districts based on their average daily attendance. In the 2018-2019 school year, every public school in the state received approximately $960 per student.Under the law, school districts with a tax rate higher than $2.75 must reduce their tax rate to account for half of their Prop C funds. As a result, the School District of Clayton would have to decrease our operating levy by eight cents, meaning the District would get the financial benefit of only a 48-cent increase from the 56-cent levy.

The alternative to asking for voter support of a Prop C Waiver would be to seek a 72-cent increase in the operating levy to end up with same net of 64 cents. However, like most districts in Missouri, the District believes that simply “waiving” Prop C is a more straightforward approach. Voters in 459 of the 518 school districts in Missouri have approved Prop C Waivers.

10. How will the funds generated from Proposition E be spent?

Proposition E will generate approximately $7.3 million of new revenue for the District each year, which is projected to be used as follows:- $5.3 million to address the projected gap between revenues and expenses for the next five years

- $1.3 million to restore reserves (maintain 18 percent fund balance)

- $700,000 for facility and maintenance needs

11. Why are there facility and maintenance needs included in Proposition E?

The District funds facility and maintenance needs from its operating budget and uses bond issues to borrow money for major renovations, new construction or large purchases of equipment. The facility and maintenance needs that were identified, but not addressed, in the District’s 2008 Facilities Master plan are now 10 years older and need to be completed. Funds from Proposition E designated for facility and maintenance needs will address:- Safety and security improvements at every school

- Infrastructure improvements that were identified in the District’s Facilities Master Plan but were not pressing enough to be included as part of the 2009 bond issue

- Updates to learning spaces/libraries to meet evolving needs of today’s learners

- Improvements to The Center of Clayton, which serves as Clayton High School’s physical education and athletics facility

12. Why is the District contributing to the planned improvements at the Center of Clayton?

The Center of Clayton was created through a partnership between the School District of Clayton and the City of Clayton. Both the District and the City contribute equally to The Center’s operation, maintenance and improvements. The Center is nearly 20 years old and the proposed improvements address a number of maintenance needs as well as improve offerings at the facility, which will benefit Clayton students and Center members.The Center of Clayton is attached to Clayton High School and replaced a number of CHS facilities when it was built. CHS students use The Center facilities on school days for physical education, team practices, weight training and, occasionally, for meeting or testing space. CHS students and WMS seventh-grade students have member status at the Center during specific hours. Groups from Wydown Middle School, the elementary schools and the Family Center also can use the facilities on school days for planned activities and events.

13. What is the difference between an operating levy and a bond issue?

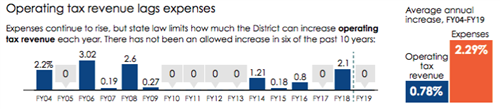

An operating levy (such as Proposition E and the one passed in 2003) provides funding for the ongoing day-to-day operations of our schools, such as paying faculty and staff, funding utilities, supplies and facility maintenance and repairs. A bond issue (like those the District passed in 2009 and 2010) is used when a school district needs to borrow money for major renovations, new construction or large purchases of equipment. This debt is paid off over time using funds that can only be used for that purpose. Funds approved for a bond issue cannot be used for operating expenses.14. Expenses have only increased an average of 2.29 percent over the last 15 years. What steps has the District taken to control expenses?

The District controls expenses by taking the following steps:- Reducing staffing expenses

- Restructuring health benefits

- Re-bidding vendor contracts

- Reducing utility costs through energy conservation strategies that include utility rebate incentives for energy efficient lighting, building automation systems and the use of solar photovoltaic arrays

15. What are the District’s sources of operating funds?

The District relies primarily on local taxes for operating revenue. Actual operating revenues for the 2017-2018 school year were as follows:- Property taxes: 71.2% of total operating revenues

- Proposition C/Sales tax: 4.3%

- Voluntary Student Transfer Program: 3.4%

- State sources: 3.4% (includes foundation formula, food service and early childhood special education)

- Other sources: 17.7% (including federal grants, investment income and tuition-paying students)

16. In what ways can a school district increase its revenues?

Under Missouri law, there are three ways in which a school district can increase revenues:- Collect additional tax revenues from new construction (see next question)

- Collect additional tax revenues from increases in assessed valuation within the confines of the Hancock Amendment (see question #18 below)

- Ask voters to approve an operating levy increase (such as Proposition E)

17. How does the District benefit from new construction?

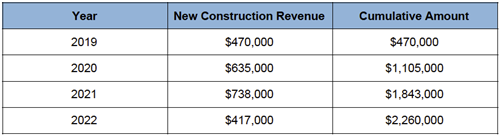

The District receives additional tax revenues from new construction (e.g., new office buildings and additions to our homes). New construction in Clayton, though appearing to be substantial, has added an average of only $285,000 of additional annual revenue over the past 10 years. Current development in downtown Clayton can be deceiving. Even though there are a number of “cranes in the air” in the Central Business District, new developments are only projected to provide the following additional revenue over the next four years.

The cumulative amount of new construction ($2,260,000 by 2022) is not enough to close the projected gap between revenues and expenditures which, absent an operating levy increase, is projected to be $4.8 million in Fiscal Year 2020.

18. How does Missouri law limit growth in the District’s tax revenue?

As assessed value of property within the District goes up, Missouri law (the Hancock Amendment) requires the District to roll back (reduce) its tax rate so that revenues from existing property can only increase at the lesser of the following three scenarios:- Five percent

- Consumer Price Index (just 1.36% annually on average for the past five years)

- The change in assessed valuation, which, if negative, causes the District’s revenue to be flat due to the fact that the Hancock Amendment protects school districts from collecting less tax revenue than they did the year before, regardless of a decrease in assessed valuations.

Consequently, the District does not benefit significantly from increases in assessed value, and operating tax revenue has remained relatively flat since the last voter-approved increase in 2003. This is a problem for many St. Louis County school districts, but especially for districts like Clayton that rely primarily on local taxes for revenue.

19. If the District is not receiving more money from increases in assessed value, why have my property taxes risen in the past several years?

In recent years, many individual homeowners have experienced increases in their property taxes. Increases have resulted from District bond issues passed by voters. State law does allow for a slight increase in revenues as explained in the previous question/response. In addition, other taxing districts (such as the library, Special School District, Metropolitan Sewer District, etc.) have passed tax increases.20. How much state funding does Clayton receive?

For the 2017-2018 school year, the state of Missouri allocated $515 per student to the School District of Clayton. This represents about 2.73 percent of the amount the District spends annually to educate a student. Based on its larger tax base in comparison with other districts in the state, Clayton is one of 194 districts that the state of Missouri has classified as “hold harmless” and has had its State aid frozen since 1992, when a circuit court found Missouri’s school financing system unconstitutional. In response to the court’s decision, the State revised its method of funding by giving districts with small property tax bases more State aid and freezing funds to districts with larger tax bases.21. Why is the School District of Clayton in need of additional financial support?

The District’s last voter-approved operating levy increase was in April 2003 and was projected to last for three years. It has lasted for more than 15 years. School districts do not have the means to increase revenue at a rate sufficient to meet rising costs because of a state law (Hancock Amendment) that limits the growth of tax revenue. Despite sound fiscal management, the District has seen expenses grow at a considerably faster rate than revenues over the last 15 years, with operating tax revenue growing an average of 0.78 percent per year while holding expenses to an average annual increase of 2.29 percent. The controlled growth in expenses still resulted in annual budget shortfalls beginning with the 2015-2016 school year. In addition to working to reduce the increase in expenses, the District has been prudently using its reserves to maintain academic excellence and close the gap between revenues and expenses for the past three years. While the new construction around Clayton has created some additional new revenue for the District, it will not be enough to close the revenue/expenditure gap.

The controlled growth in expenses still resulted in annual budget shortfalls beginning with the 2015-2016 school year. In addition to working to reduce the increase in expenses, the District has been prudently using its reserves to maintain academic excellence and close the gap between revenues and expenses for the past three years. While the new construction around Clayton has created some additional new revenue for the District, it will not be enough to close the revenue/expenditure gap.22. The District is always carefully monitoring its financial situation. Why act now?

The District is asking voters to consider an operating levy increase in April 2019 because the Board of Education and District Administration believe they have limited spending as much as possible without negatively impacting the quality of education students receive. The District is always reviewing its financial situation. As early as 2012, the District became aware of potential budget shortfalls and took a variety of cost-controlling measures to address the shortfalls, reducing expenses that year by a total of $2.8 million. The District continued to analyze its budget for further efficiencies. Even with the reductions, the District has had to prudently use its reserves to maintain academic excellence and close the gap between revenues and expenses for the past three years.23. Couldn’t we just solve this problem by reducing our budget even further?

The Board of Education and District Administration believe that another wave of expenditure reductions would result in staffing cuts that would have a significant negative impact on the education of our students. For example, in order to balance the 2019-2020 budget the District would have to cut approximately $4.8 million from its budget, which is the equivalent of 50 teaching positions. Since 80 percent of the District’s budget is personnel, any budget reduction would have to include a significant reduction in teaching staff.24. Can’t the District just use the revenue from the sale of the Maryland School to close the gap?

The District sold the Maryland School for $4.1 million in July 2017. The Maryland School was a capital asset and, at the time of sale, the Board designated the funds for future capital needs.25. What is the fund balance approach to school finance?

School finance follows a cyclical pattern. A school district builds its reserves in the years when revenues exceed expenditures, usually following a voter-approved levy increase. Districts then spend down their reserves as operating expenses begin to catch up with and then exceed operating revenues.A school district’s reserve, or fund balance, is the amount of money that is left in the bank at the end of a fiscal year. School districts throughout Missouri carry fund balances that range from 10 percent to 40 percent of their annual budgets. A district’s fund balance serves two main purposes:

- To ensure adequate cash flow for operations throughout the fiscal year

- To offset expenditures in years when expenses outpace revenues

When a district’s fund balance falls below its required minimum, it must either reduce expenditures, increase revenues or a combination of both.

26. Why does the District need reserves?

School districts like Clayton, which are funded primarily by local property taxes, receive most of their tax revenue in December and January of each year. As a result, Clayton must keep enough of its budget – at least 18 percent – in reserve to ensure it will have adequate cash flow to fund operations without borrowing money throughout the course of the year. For the 2018-2019 school year, the District currently has a reserve (or fund balance) of 25 percent. Each year that reserves are used to offset expenditures erodes the District’s fund balance. Absent any budget reductions or revenue increases, the District’s fund balance will fall below its 18 percent goal in the 2019-2020 school year.27. How much of the District’s budget is used to pay teachers and District staff?

Salaries and benefits for all District staff comprise more than 80 percent of District expenses.28. What are the District’s current five-year enrollment projections?

The District’s most recent enrollment projections show a slight increase (two percent) in total enrollment over the next five years, with resident enrollment increasing and voluntary transfer and statutory tuition enrollment both decreasing. These projections are consistent with a demographic study completed in 2015-2016, which examined recent population changes in the District, including home sales and new construction; population projections based on historical demographic census data from various census databases; exploration of birth and kindergarten enrollment trends and their relationship; and analyses of historical trends in the District’s K-12 resident enrollment.29. What is the projected impact on enrollment from all the high-rise, residential construction in downtown Clayton?

A 2015-2016 demographic study estimated that these new developments would bring few students, projecting the number to be 2.9 new students for every 100 units. This trend continues to hold as the District enrolled 8 new student(s) from new developments for the 2018-2019 school year and one new student from new developments during the 2017-2018 school year. The District has been tracking enrollment of students residing in residential high rise or downtown Clayton apartments since 2012-2013.30. How does the School District of Clayton’s operating levy compare with other county districts?

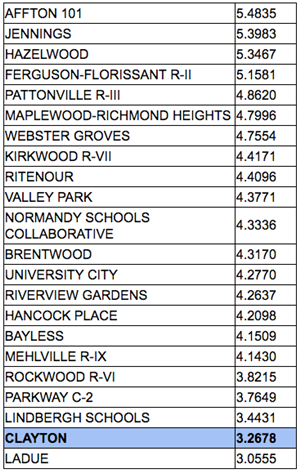

The School District of Clayton has one of the lowest operating tax rates in St. Louis County. (Rates listed below are 2018 rates.)

31. Why is the School District of Clayton’s per pupil expenditure higher than other area school districts?

Several factors contribute to the amount of money the School District of Clayton allocates per pupil. A cornerstone of providing our students with a high-quality education is employing high-quality teachers. Salaries are based on experience and education; our teachers have an average of 17 years of teaching experience, and more than 95 percent have a master’s degree or higher. In order to attract and retain high-quality teachers and staff, we maintain a competitive salary schedule and offer benefits to our staff including a stipend for earning National Board Certification in their content area and the ability to enroll their children in Clayton’s schools.Our low 11:1 student/teacher ratio provides more individualized attention for our students, though it requires a greater amount of staffing. Clayton provides our students with several unique programs, such as academic summer school programs at every level and Clayton High School’s Conferenced English Program, which also incur higher staffing costs. These programs are an integral part of our students’ K-12 educational experience and contributing factors to the high-quality education we provide for each student.

32. What are the voluntary student transfer and statutory tuition programs, and how do they impact the District’s budget?

The voluntary student transfer program allows African-American students residing in the City of St. Louis to attend participating school districts in St. Louis County as part of a settlement agreement reached in a St. Louis desegregation case in 1983. All participating districts receive $7,000 per student in state aid.The statutory tuition program includes the students who transferred to Clayton when the Normandy and Riverview Gardens School Districts lost their accreditation with the Department of Elementary and Secondary Education. Through a state statute, these students were allowed to transfer to an accredited school district in St. Louis County or an adjoining county, with their home school district paying tuition to the receiving school districts.

Since that time, Normandy has regained provisional accreditation and Riverview is fully accredited. However, in both cases, Clayton’s Board of Education entered a Memorandum of Understanding (MOU) with each school district that establishes a transition plan for the students to remain in Clayton until they reach a natural transition in the next grade span (promotion from fifth grade, eighth grade or 12th grade) to allow for continuity in educational services for the students. At the request of Normandy and Riverview, the MOUs also state that Clayton would accept a lower tuition amount - $7,000 per student - for the remainder of the students’ time in Clayton. All school districts who received transfer students also agreed to accept the lower tuition amount and additional terms of the MOU.

While the funds Clayton receives for the voluntary student transfer and statutory tuition programs is less than our per pupil expenditure, we are not incurring additional staffing costs because of this enrollment. Instead, these students are filling seats in existing classrooms, within the District’s class size targets, that otherwise might be empty. Therefore, these programs are an additional revenue source for the District.

33. Why won’t the District receive enough revenue from the expected increases in 2019 real property assessments to cover the District’s projected gap between revenue and expenses without passage of Proposition E?

The Hancock Amendment restricts the amount of revenue the District is allowed to receive from an increase in assessments by requiring the District to roll back its tax rate to the lesser of five percent, the Consumer Price Index (1.9% in 2019) or changes in assessed valuation. Therefore, the largest increase the District would be allowed to receive is the CPI, which is not enough to cover the $4.8 million gap between revenue and expenses. See question #18 for more information about the Hancock Amendment.

34. Could the expected increase in County-wide assessed values due to reassessments result in more revenue coming to the District from Proposition E than was originally projected?

If assessed values increase due to reassessments as expected, the District could be in a position to receive more revenue than originally projected from the passage of Proposition E. However, the District administration is focused on its financial needs, as demonstrated throughout this document, and will recommend that the Board of Education commit to a voluntary rollback in the District’s tax rate following the reassessment process to ensure that no more than the $7.3 million of revenue originally projected from passage of Proposition E is actually collected by the District. The Board of Education would vote on this voluntary rollback in September.

A "voluntary rollback" is a term used to describe the action taken by a taxing body such as a school district to not levy or charge the fully approved and taxpayer authorized tax rate. If a district voluntarily reduces their tax rate in an odd numbered reassessment year (2019), the voluntary rollback will continue for two years (2019 and 2020) until reassessment occurs again (2021) per Missouri statute.Updated 03/25/19